Sluggish

Demand for most commodity resins was generally lackluster in the first quarter and the beginning of the second.

Demand for most commodity resins was generally lackluster in the first quarter and the beginning of the second. Both resin and monomer prices were generally soft. Nonetheless, polyethylene suppliers announced price increases in hopes of halting further erosion. Suppliers also are watching closely to see if processors start stocking up on resin as the hurricane season approaches.

PE prices down

Polyethylene prices dropped further in April, so the total slippage since December reached 18¢/lb. The drop last month was 2¢ as compared with 4¢ declines in each of the previous three months, perhaps signaling that prices are hitting bottom. Resin suppliers are attempting to show as much with a new price hike of 6¢/lb issued by most of the major players for May 1. Chevron Phillips and Formosa asked for only 3¢/lb.

There’s also upward price movement at the London Metal Exchange (LME), where May’s short-term futures contract in g-p butene-LLDPE for blown-film was 53.8¢/lb, up from April’s 51¢/lb.

Contributing factors: Some resin suppliers see low resin inventories at processors as a factor in their favor. They expect to implement their new prices, at least partially, either this month or in June.

Ethylene monomer contract prices dropped 3.5¢/lb in February and 2.5¢ in March. According to resin-purchasing consultant Resin Technology Inc. (RTI) in Fort Worth, Texas, monomer buyers are looking to shave off another 1¢ to 3¢ to close the unusually big gap between contract and spot prices. March contract prices stood at 47.5¢/lb and spot prices were in the low 30¢/lb range.

PP prices flat

Polypropylene prices were stable in early April, after moving up 4¢ to 6¢/lb in the previous two months. There was industry chatter that a new price increase would be announced for May or June. However, the LME’s May short-term futures contract for g-p injection-grade PP homopolymer is 50.1¢/lb, down from April’s 51¢/lb.

Contributing factors: Attractive resin deals were available into early April, and RTI sources said some processors were already “getting back” 4¢/lb of those earlier price hikes. Still, suppliers expect some uptick in demand in the second quarter, and perhaps a bit more. Says one major supplier, “There is lots of talk about hurricane stockpiling.”

Propylene monomer prices moved up a total of 6¢/lb from January to March, and April contracts seemed likely to rise another penny or two.

PVC falls 2¢

As expected, PVC resin prices lost 2¢/lb in March, while resin producers delayed their pending 2¢ increase yet again, this time to May 1. It was originally announced for January 1.

Contributing factors: PVC demand was still weak in mid-April, with no sign of the usual spring build-up. Falling ethylene monomer prices are also putting downward pressure on PVC.

PS continues to weaken

Polystyrene prices, already down about 6¢ from November through March, were expected to lose another 1¢ to 2¢/lb in April. Styrene monomer was flat in mid-April, but spot monomer fell as low as 45¢/lb, which was below cost.

Contributing factors: Polystyrene is still in oversupply, and demand is weak for this time of year, which is usually fairly strong. March demand was perhaps 10% below normal for what is usually a strong month. High resin prices have hurt PS in cup, lid and cutlery markets, which have shifted to paper, PET, and PP respectively. In durable goods, however, PS is still strong for the time of year, resin producers say.

Composite resins rise

Owing to continuing petrochemical supply disruptions caused by Hurricane Katrina, isopthalic acid feedstock for unsaturated polyesters has been more expensive and hard to get. That’s the reason cited by AOC, which hiked all its isophthalic-based resins and gel coats by 3¢/lb on May 1.

| Market Prices Effective Mid-Apr A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

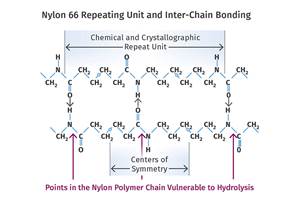

What is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreScaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More