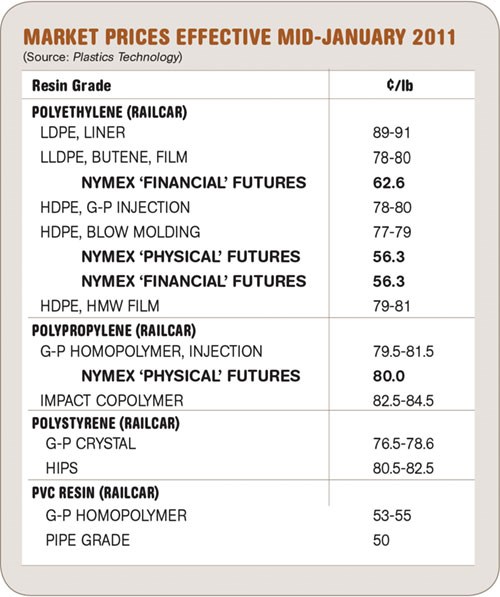

Sticker Shock: PP Prices Soar By 17¢/lb

Other commodity materials flat to down.

Monomer supply problems ignited a startling run-up in polypropylene prices last month, even though demand was slack. Polystyrene prices were also trending upward, though polyethylene and PVC were on a flat to downward path. But there are plenty of wild cards on the table. Keep an eye out for unplanned outages of monomer and feedstock plants and revival of domestic and export demand, say resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas.

PP PRICES THROUGH THE ROOF

Polypropylene prices were heading for a shocking 17¢/lb increase last month, in step with 17¢/lb higher January contract settlements for propylene monomer, which leaped to 77.5¢/lb. A couple of PP suppliers were even asking for a 19¢ hike but are considered highly unlikely to get it.

This dizzying upswing is linked directly to feedstock shortages due to several planned and unplanned outages at refineries and steam crackers. It certainly wasn’t demand-driven. PP plant operating rates were in the mid-to-upper 80s percentage range from October and through December. PP sales came to a standstill in mid-December and supplier inventory levels actually increased. Sales are likely to be suppressed by the massive impending price hike.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed. After the January surge, PP prices may sit tight in February and even pull back a bit. A further price “correction” could come in March, if the demand slump continues. Expect PP suppliers to quickly throttle back plant operating rates.

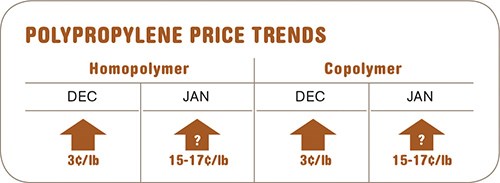

PE PRICES FLAT FOR NOW

Polyethylene prices were flat last month, despite suppliers’ attempts to a push through their delayed December 5¢ increase and January 6¢ hike. Nymex HDPE futures were also down 2.7¢/lb from last month. One reason is that ethylene monomer spot prices dropped to 41-42¢/lb in mid-January from 46¢ in mid-December and 52¢ in November. Both monomer and polymer supplies are ample. Sluggish domestic and export demand for PE continued into last month.

Outlook & Suggested Action Strategies

30-60 Days: Polyethylene pricing for the initial part of the first quarter is expected to be mainly cost-driven and appears to be trending downward. Buy as needed. Unplanned monomer and polymer outages could change things quickly.

Also, exports and inventory levels may come more into balance with demand by late in the quarter; particularly if China comes back into the market buying heavily and crude oil prices remain high.

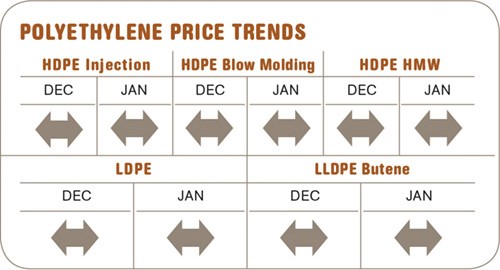

PS PRICES UP TO FLAT

Polystyrene prices were expected to move up last month although not by the full 6¢/lb sought by suppliers. That increase included the removal of a 2¢ TVA from December plus the January 4¢ hike. A 3-4¢ actual increase was more likely, due to higher feedstock costs.

January benzene contract prices moved up 56¢/gal to $3.84, driven by high oil prices and refinery outages. Moreover, styrene monomer contract prices for January were poised to rise 4-5¢ to 66-68¢/lb. Ditto for butadiene prices, with December contracts up 2-3¢ to 87¢/lb, driven by strong global demand. January contract proposals for butadiene were 5-6¢ higher, and prices could pass $1/lb before the end of March.

December PS plant operating rates moved up to 82% from the high 70s, and demand was up due to prebuying for restocking inventories after November production outages.

Supplier inventories were expected to drop lower than the 19-day mark in December for GPPS and HIPs but move up from the 24-day mark for EPS.

Outlook & Suggested Action Strategies

30-60 Day: January prices were on the way up and HIPS prices were anticipated to remain at a higher-than-normal premium over GPPS. January resin prices look like the peak for the quarter. Flat to downward pricing is likely for this month.

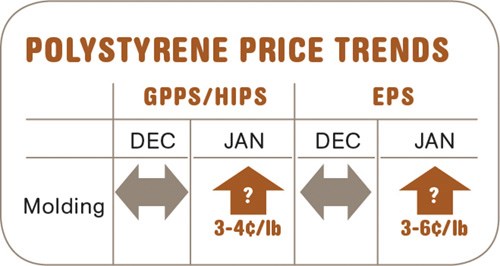

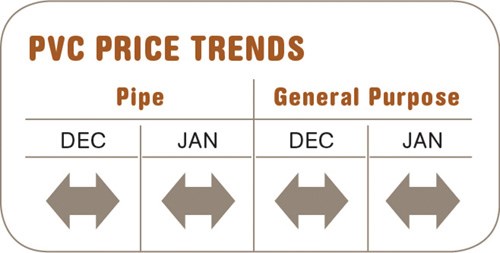

PVC PRICES FLAT TO DOWN

PVC prices in January were flat for a second month, despite suppliers’ issuing a 3¢/lb price hike for Jan. 1. By December, domestic and export demand had dropped by more than 5% and by 10%, respectively, while plant operating rates fell more than 9% by year’s end. This has brought some attractive spot-price deals.

The trend to flat-to-lower PVC prices in the first quarter follows falling prices for ethylene monomer, whose supplies have become ample, as well as more PVC hitting the market from the start-up of Shintech’s capacity expansion last quarter. What’s more, Formosa will be starting up a capacity expansion before March’s end for a net addition of 240 million lb/yr.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed, since prices could go lower this month. Some planned plant shutdowns will limit the oversupply situation, but supplier inventories will grow as domestic and export demand declines further though this quarter. Expect further opportunities for price reduction, barring any significant production outages of raw materials or PVC resin.

Related Content

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MorePolymer Science for Those Who Work With Plastics: Why Entanglements — Not Just Molecular Weight — Drive Plastic Performance

Ever try running your fingers through tangled hair? Yeah … that’s not fun, but that’s what happens at the molecular level when polymer chains reach the right length. They wrap around each other, intertwine and … get stuck — and those tangles are the real reason plastics perform the way they do.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MorePrices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More